Are you tired from constantly juggling your money? Do you wish of having extra fiscal freedom? Well, one powerful way to attain those goals is by carefully here reviewing your essential spending and uncovering areas where you can reduce.

It's remarkable how much money we often expend on routine items that are genuinely essential. By adopting a few simple changes, you can significantly decrease your expenses and unlock more cash for the things that authentically matter.

- Evaluate your present spending habits.

- Record where your money is going for a duration.

- Pinpoint areas where you can reduce expenses.

- Negotiate lower rates with your provider companies.

- Explore budget-friendly alternatives.

Remember, even insignificant changes can accumulate to big savings over time. So, begin your journey towards financial wellness by cutting your essential spending today!

Master the Art of Smart Shopping

Smart shopping isn't just about scooping up great offers. It's a skill that involves thoughtfulness, and knowledge to ensure you get the {best{ value for your money. A smart shopper understands how to analyze prices, leverage coupons and sales, and browse the market with assurance.

By embracing these strategies, you can transform your shopping journey from a chaotic affair into a pleasurable one.

Here are some fundamental tips to guide you master the art of smart shopping:

* Look into products prior to you buy them.

* Contrast prices from multiple sellers.

* Employ coupons and promotions whenever possible.

* Evaluate the extended value of a product, not just its initial price.

* Acquire items during promotional sales for substantial savings.

By following these tips, you can become a savvy shopper and maximize your financial resources.

Trim the Fat from Your Regular Expenses

Are you feeling the pinch of growing costs? It might be time to review your regular payments and see if there's any room to reduce. You can often reduce a surprising amount of money by negotiating lower rates, discovering better deals, or even eliminating some services you no longer require.

- Start by making a list of all your regular bills.

- Analyze each payment and wonder if there's a cheaper substitute available.

- Reach out to your companies and inquire lower rates.

Money Saving Strategies for Everyday Spending

Want to boost your savings without sacrificing your favorite things? It's absolutely possible! Start by monitoring your spending. You'll be shocked at where your money is going. Then, create a budget that works your needs. Look for tiny ways to trim costs on a regular basis. For example, pack your lunch instead of eating out. Make your coffee at home instead of buying it on the go. Shop around for better prices on household supplies. And don't forget to bargain bills and look for promotions.

- Think about using cash instead of credit cards. It can help you remain within your budget.

- Establish financial goals to inspire yourself to save.

Save Big Savings on What You Need Most

Are you looking for the best deals on the products you need the most?? Look no longer. We have a wide selection of incredible offers that will assist you save money on everything from appliances to clothing. Don't waste this chance to get what you desire at costs that are compelling.

- Shop now and find the deals you've been looking forward to

Thrifty Living Made Simple: Save More, Enjoy More

Embarking on a journey to become more financially responsible doesn't have to be overwhelming. With easy-to-implement strategies, you can boost your financial well-being. Start by designing a budget that analyzes your income and expenses. Identify areas where you can trim spending, such as having meals away from home.

- Look into affordable alternatives for your routine purchases.

- Compare prices before making significant investments.

- Set financial goals to stay motivated.

Bear this in thought that even minor adjustments can make a difference on your financial progress.

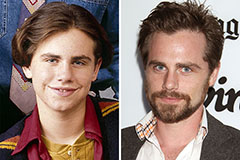

Rider Strong Then & Now!

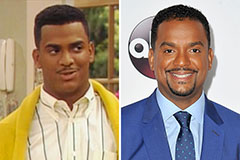

Rider Strong Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!